Over the years, scams and its operations has grown tremendously, people whose only intent is to claim what is not theirs come up with various conning plans on how to deceive and steal from others.

On this article, we shall look at a few of some of the biggest scams in history, those behind the master plan and how their plans were successfully carried of before getting caught.

Now let’s give scamming a proper definition:

Scamming is called the act of performing various schemes and deceptive actions for the purpose of making money and defrauding a person or group of people of something of value by deceit.

Ways to scam clients is to gain their trust by deception, seduction, or a promise, and then deceive and extort money. Scammers often use phishing, lottery scams, mail and middling fraud, and other tricks to cheat gullible people.

The widespread spread of various types of scams both on the Internet and in offline life shows that it is extremely important to be aware and be able to protect oneself with knowledge.

Now let’s take a look at a few of these scams

7. Emmanuel Nwude:

A Nigerian, who sold to a Brazilian bank, Nwude is not. Instead, Nwude is the man behind one of the biggest scams in history, having managed to ‘sell’ a non-existent airport to a Brazilian bank for $242 million.

In this incident, the Nigerian man posing as a high-ranking official managed to deceive the bank basing of a fake airport venture, with Banco Noroeste subsequently collapsing after falling for Nwude’s intricate ‘419 scam’.

There is no doubt that Nwude’s actions were fraudulent, with the subject having orchestrated complex logistical pathways in order to defraud the bank of a large sum of money.

Hence, Nwude’s scheme was eventually exposed due to negotiations concerning a purchase deal. Nwude was arrested and charged and eventually found guilty.

In 2005, he was found guilty of fraud and given a 25-year prison sentence. This was a major win for Nigeria’s recently formed Economic and Financial Crimes Commission (EFCC).

Nwude returned to court in 2021, having served a portion of his term, although he denied knowing where the money from the scheme came from. He stated that the money in his accounts were not the proceeds of fraud, despite his legal team’s advice to enter into a plea deal with the EFCC.

Nwude talked about sending money via a number of accounts and people, such as his acquaintance Naresh Asnani, an Indian, who helped arrange transactions with a Swiss bank.

Furthermore, he claimed that Mr. Olisa Agbakoba, a Senior Advocate of Nigeria, had deserted him after receiving a sizeable legal fee.

The elaborate nature of financial fraud and the extent people will go to in order to mislead and cheat others are demonstrated by Nwude’s scheme.

His example serves as a reminder of the value of strong regulatory frameworks, thorough investigations, and punitive measures in the fight against fraud and defense of the integrity of financial institutions.

6. Frank Abagnale Jr.

He is known for posing as a Pan Am pilot, a doctor, and a lawyer and successfully passing millions of dollars in fraudulent checks. He was portrayed by Leonardo DiCaprio in the movie “Catch Me If You Can.”

In addition to other dishonest methods. Abagnale used complex tactics to obtain people’s confidence and financial resources, including faking checks, posing as professionals, and influencing others.

But new research and writings, including Alan C. Logan’s book “The Greatest Hoax on Earth: Catching Truth, While We Can,” cast doubt on the veracity of Abagnale’s allegations and the scope of his illicit activity.

These sources put doubt on the veracity of Abagnale’s life narrative and the full scope of his fraudulent actions by implying that several of his stories may have been erroneous, misleading, overstated, or wholly untrue.

Frank Abagnale Jr. employed a number of complicated deceptions and fraudulent practices to carry out his schemes. Several crucial facets of his con artistry encompass:

Impersonation: Abagnale played a number of professional people, such as a professor from Columbia, a Harvard lawyer, a Harvard resident physician, and a Pan Am copilot. He was able to obtain information, services, and privileges that he would not have otherwise been able to by adopting these phony identities.

Adaptability and Innovation: Abagnale’s success as a con man was largely due to his capacity for technological and situational adaptation. He used fictitious pilot credentials to take advantage of loopholes in the airline business and eventually shifted to medical fraud and legal impersonation to further his fraudulent activities.

False Claims: Abagnale’s assertions have been called into question by recent publications and investigations, which contend that many of his tales may have been wholly untrue or inaccurately, misleadingly, or overstated. This raises questions about the veracity of his illegal activities and the scope of his deceit.

Overall, Frank Abagnale Jr.’s scams were characterized by a combination of impersonation, check fraud, social engineering, adaptability, and innovation, allowing him to deceive individuals and institutions for personal gain.

5. Sarah Howe:

Sarah Howe, who was born in Providence, Rhode Island, in 1826, was a participant in the Ladies’ Deposit Company fraud in Boston in 1879.

She said that a Quaker charity backed Howe’s bank, which was essentially an early Ponzi scam. By offering high interest payments of 8% per month to single women, she drew deposits from them and eventually amassed about $500,000 (about comparable to $13 million today) from 1,200 savers.

Howe’s scam was similar to a Ponzi scheme in that it paid interest to depositors from the funds of later investors instead of from gains from legal investments.

Even though her fraudulent scheme was initially successful, bad press caused depositor confidence to decline, which resulted in a bank run. Howe made an effort to pay back some of the money, but she ultimately stole $50,000 before being apprehended and given a three-year prison sentence for her fraudulent actions.

Howe’s case serves as a reminder of the perils of financial fraud as well as the need of exercising caution and due diligence when considering high-yield investment options that look too good to be true.

4. James Hogue:

A notorious con man, who participated in a string of deceptive practices over several decades in several jurisdictions, including Colorado, New Jersey, and California.

Hogue’s criminal past included taking on fictitious personas, misleading law enforcement, and committing several crimes and scams.

He took on the identities of a Ph.D. bioengineer, a high school student, a track athlete, and a professor in order to apply for scholarships and financial aid.

Hogue committed a number of frauds, such as using false identities to apply for schools, stealing bicycles and valuable stones, and selling stolen goods on the internet.

His unlawful actions resulted in numerous arrests and convictions for offenses including fraud, theft, and obstruction of justice.

Hogue was able to carry out a number of fraudulent schemes thanks to his sophisticated deceptions and ability to manipulate situations to his advantage.

These actions eventually led to his imprisonment for his crimes and several run-ins with the law.

3. Gregor MacGregor:

One of the most daring con artists in history, the Poyais swindle, was masterminded by another infamous con man.

MacGregor asserted himself as the Cazique, or prince, of the imaginary Poyais country, situated near the Black River in Honduras, in 1822.

He made up a lengthy tale about Poyais being a wealthy nation with plenty of resources, lush land, and stunning architecture in order to lure investors in with promises of opportunity and money.

MacGregor deceived investors about the growth and prosperity of Poyais, which was actually a deserted jungle, in order to sell almost a billion dollars’ worth of “Poyais bonds” in London.

This swindle, one of the most notorious confidence tricks in history, claimed the lives of numerous settlers who had moved to Poyais on the basis of MacGregor’s false promises.

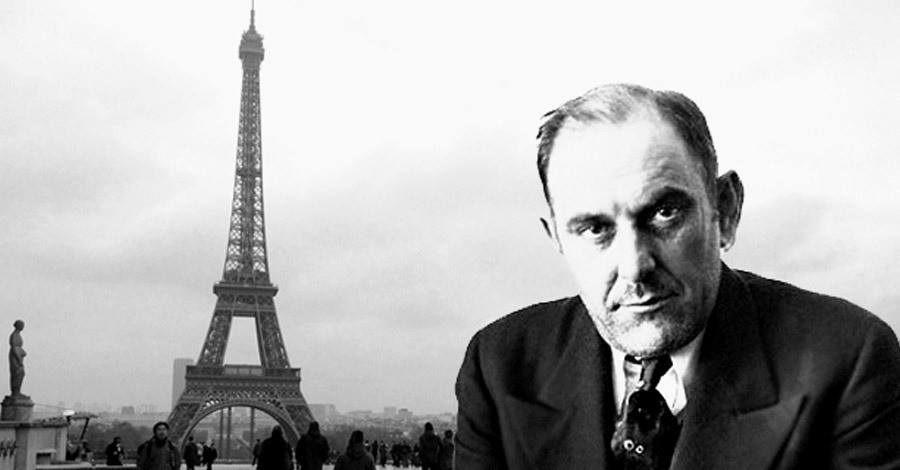

2. Victor Lustig:

A well-known scammer, most recognized for his daring ruse involving the Eiffel Tower. Using charm, cunning, and skillful manipulation, Lustig accomplished the amazing accomplishment of selling the Eiffel Tower twice.

Lustig’s complex plan involved persuading André Poisson, a businessman, that he could buy the Eiffel Tower from the French government and disassemble it for scrap, with the promise of large financial gains.

Lustig was able to pull off this enormous con because to his ability to conjure up a convincing fantasy and trick his victims into accepting his invented stories.

Lustig’s criminal actions went beyond the renowned deception he pulled off to include schemes throughout Europe and North America that solidified his status as one of history’s most infamous figures, even if he was successful in selling the Eiffel Tower.

His expertise in the art of deception was demonstrated by his ability to talk his way out of charges and temporarily elude the law.

In the end, Lustig’s deceitful actions caught up with him, resulting in his apprehension, verdict, and a 20-year confinement in Alcatraz, during which he passed away for 14 years.

The reputation of expert con artist Victor Lustig serves as a warning about the perils of falling for enticing con artists who take advantage of trust and credulity for their own gain.

1. Charles Ponzi:

An Italian immigrant gained notoriety for running what is now recognized as a Ponzi scheme.

Ponzi founded the Securities Exchange Company in 1919 and promised investors quick and large returns by taking advantage of the differential in value between international postal reply coupons.

With the prospect of large profits—a 50% return in 45 days or a 100% return in 90 days—he drew investors in. In Ponzi’s plan, money from new investors was used to reimburse previous investors, giving the impression of profitability even in the absence of real profits.

Despite his early success and quick rise to fame and fortune, Ponzi’s fraudulent schemes finally came undone, bringing down his empire.

Since its creation, the Ponzi scheme—named after Charles Ponzi—has come to represent dishonest investment schemes that promise large returns but eventually cause financial losses for many participants by using the funds of new investors to pay off those of previous ones.

In summary

For those who do them, scams can be extremely profitable, frequently yielding substantial sums of money through dishonest methods.

People who have defrauded victims of significant amounts of money include Charles Ponzi, Victor Lustig, and Gregor MacGregor.

They have done this by taking advantage of trust, gullibility, and the promise of huge profits.

As demonstrated by Ponzi schemes, which use the funds of new investors to pay returns to previous investors, these frauds can result in enormous profits for their operators while providing the appearance of profitability without any real gains.

Scams, however, also present serious risks to people and the wider community.

Scam victims may experience severe financial losses, psychological suffering, and harm to their reputation.

When confronted with investment possibilities or schemes that appear too good to be true, people should be cautious, skeptical, and do their research because falling for a scam can have serious, long-lasting consequences.